In Odoo, accounting entries can be managed according to two primary accounting modes: Continental (also known as French or General Accounting) and Anglo-Saxon. These modes affect how and when accounting entries are created for inventory transactions, among other things. In this blog,we discuss the differences between Continental and Anglo-Saxon accounting by diving into journal entries for purchase orders, sale orders, manufacturing orders and inventory adjustments.

1) Continental Accounting

Expenses and revenues are recorded immediately upon the purchase and sale of goods.

When goods are purchased, an expense is recorded immediately.

When goods are sold, the corresponding revenue is recorded.

This method is often used by companies that do not need to track the cost of goods sold (COGS) separately from inventory value in real-time.

In accounting, inventory can be validated either manually or automatically. When done manually, stock levels aren't immediately updated and must be adjusted at the end of the month or year.Before diving into continental accounting we must ensure that anglo -saxon accounting is disabled.

Example Product Category Configuration

Product Category Configuration, ensuring that its inventory valuation is set to Automated so that the accounting entries are recorded automatically and set account stock properties.

Let's now consider a purchase operation for the product Office chair black and examine how it affects the ledgers in continental accounting.

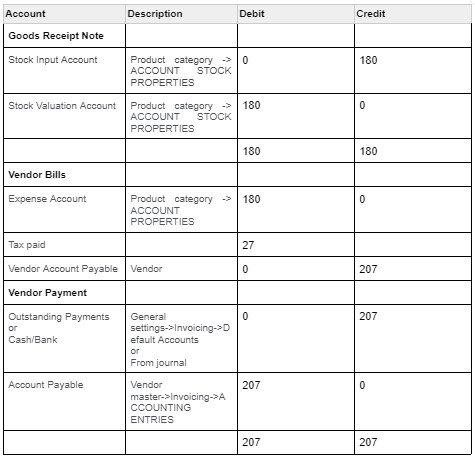

Purchase orders do not directly affect the accounts as they simply serve as business documents. However, once the goods are received, the purchase receipt triggers changes in stock accounts, impacting the ledger.

Upon receiving the stock, the input account records the value of the received stock, thus increasing the current stock value. Next, we will examine the stock journal.

The received stock is considered a liability, and according to the asset-liability accounting principle, an increase in liability is credited. Therefore, the stock interim received account is credited while the stock valuation account is debited. The stock valuation account reflects the current asset value, so as the asset increases, the stock valuation account is debited.

Now,let’s create the bill for the purchase order.

In the journal items tab, you can see the ledger details where the expense account is debited and the accounts payable is credited. When creating a bill, the company incurs a liability to pay the vendor, recorded as accounts payable. Since accounts payable is a liability, it is credited as the liability increases. Additionally, the purchase increases the company's expenses, which is recorded by debiting the expense account.

The next step is to make payment to the vendor, When creating a payment, a payment journal entry is generated, recording the accounts payable and outstanding payments.

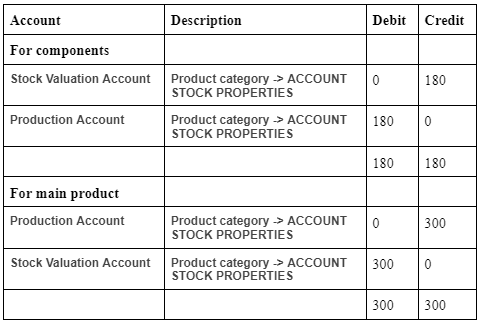

Manufacturing Order

Consider Desk Combination as the main product and it has 3 components as depicted below.

In the above purchase order we purchased Office Chair Black component only,we assume the remaining products are already available in stock.

When a stock journal entry is created during a manufacturing order, the stock valuation account is credited and the production account is debited for the components, while for the main product, the stock valuation account is debited and the production account is credited.

Sales Order

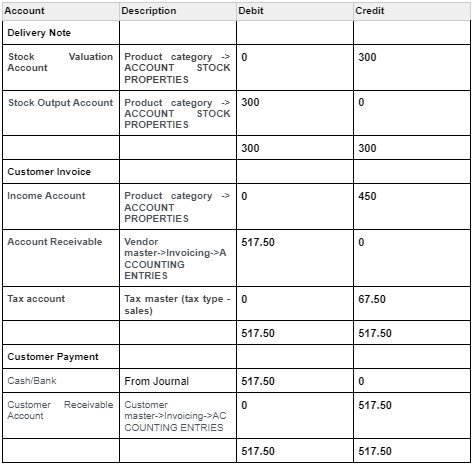

Now,Let’s sell some purchased products and deliver them.

Upon delivering the products, the stock is affected, which in turn impacts the stock ledgers due to automated inventory valuation. The stock result record reflects the value of the delivered stock in the stock output account, reducing the current stock value. Next, let's examine the stock journal.

In this scenario, the stock output account is debited because the liability is decreasing, and the stock valuation account is credited because the asset is decreasing.Next we create an invoice.

The income account "Product Sales" is credited, as it represents an increase in income from the sale. Conversely, the accounts receivable account is debited, indicating an increase in the asset representing the amount owed by customers.

When payment is made, the accounts receivable amount decreases. Since accounts receivable is an asset, a decrease in assets results in a credit entry. The counterpart account, "Outstanding Receipts," represents the money pending reconciliation and is debited.

2) Anglo-Saxon Accounting

Small communities often prefer the Anglo-Saxon accounting method, which is available in the enterprise edition of Odoo.We can activate this feature in the company as shown below.

Expenses are recorded when goods are sold (matching principle), and the cost of goods sold (COGS) is tracked more precisely.

When goods are purchased, the cost is recorded in an inventory account.

When goods are sold, the expense is moved from the inventory account to the COGS account.

This method is preferred by companies that need to match expenses with revenues, providing a more accurate picture of profitability for each sale.

While purchase of products,Goods receipt note, Vendor Payment entries are the same like Continental accounting. The only difference is in Vendor Bills.

While Sale of products,Delivery note, Customer Payment entries are the same like Continental accounting. The only difference is in Customer Invoice.

After validating a Purchase order,Check the Journal Entries to find the journal items corresponding to the entry for the purchase of the product.

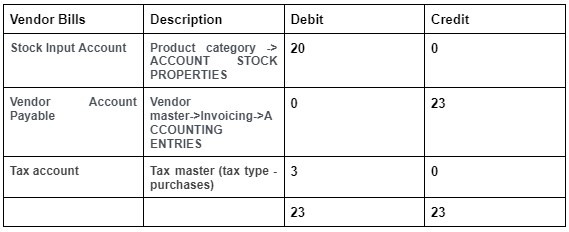

For Instance,let’s take drawer black as product,Vendor bill of Anglo-saxon accounting is given below.

Thus in Anglo-Saxon accounting, the expense account is not impacted until goods are sold or delivered, unlike Continental accounting where it is affected when goods are received into inventory.

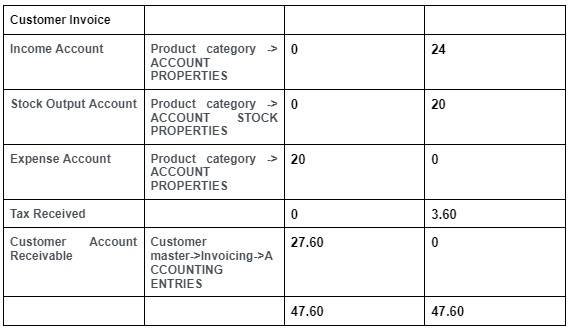

Customer Invoice of Anglo-saxon accounting is given below.

Here,the expense account is configured as cost of goods sold account as shown below.We can configure accounts within product configuration,product category configuration etc.

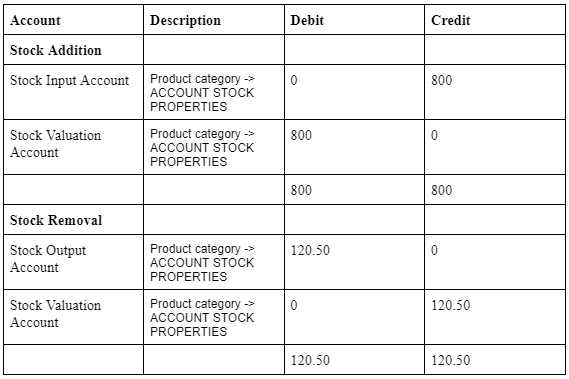

3) Accounting Entries in Inventory Adjustment

In Inventory, when a stock journal entry is created, adding products credits the stock input account and debits the stock valuation account. Removing stock debits the stock output account and credits the stock valuation account. These entries ensure accurate reflection of inventory values and related accounts in your financial statements.

stock removal example